Summary

As cloud adoption grows in fintech, cloud cost management becomes harder because usage and pricing shift every hour. FinOps helps teams link spend to real outcomes like cost per transaction, fraud checks, and feature delivery. Learn how fintech teams apply FinOps in daily operations, using tagging, visibility, forecasting, and automation to turn cloud spend into strategic value.

Introduction

Cloud makes fintech faster. Teams can ship features quickly, scale during peak transaction windows, and run analytics without buying hardware.

The catch is simple: consumption pricing turns every new workload into a variable cost line. And in fintech, workloads spike for reasons that feel “business as usual” such as payout cycles, fraud bursts, seasonal lending, or a partner API change.

FinOps exists to keep that variability from becoming chaos. The FinOps Foundation defines FinOps as an operational framework and cultural practice that maximizes business value from cloud and technology through timely, data-driven decisions and shared financial accountability across engineering, finance, and business teams.

This guide shows what FinOps looks like when you apply it day to day in fintech environments, where speed, governance, and predictability matter at the same time.

Why fintech teams feel cloud cost pressure sooner

Fintech cloud usage tends to concentrate in a few expensive areas:

- Always-on customer experiences: low-latency apps, APIs, identity, and observability.

- Risk and fraud analytics: streaming, feature stores, model training, and bursty compute.

- Data platforms: warehouses and lakehouses that grow quietly with retention, audit, and regulatory needs.

- Security controls: logging, monitoring, scanning, and encryption overhead that is necessary, but rarely “free.”

And cloud spend keeps climbing across industries. Gartner forecasts public cloud end-user spending at $723.4B in 2025.

So, the question for fintech leaders is rarely “should we spend less?” It’s “how do we spend with intent, and prove it with numbers?”

That’s where FinOps becomes a business discipline, not a billing exercise.

FinOps in daily operations: the practices that change outcomes

1) Unify teams around shared financial accountability

FinOps works when engineering and finance stop treating cloud cost as someone else’s job. The practical shift looks like this:

- Finance gets clear ownership views: by product, environment, and business line.

- Engineering gets fast feedback loops: cost impact is visible before and after a release.

- Product and leadership get unit economics: cost per transaction, cost per active customer, cost per underwriting decision, cost per fraud check.

Example

Before launching a new real-time payments feature, the platform team reviews expected throughput, storage growth, and observability overhead with finance. They agree on a target unit cost (say, cost per 1,000 transactions) and track it weekly. If unit cost rises, teams investigate whether it came from higher log volume, unbounded retries, or an over-sized compute tier.

What Inferenz typically adds here is the operating model: who owns which cost domains, what gets reviewed weekly versus monthly, and how teams turn cost data into decisions without slowing delivery.

2) Make cost visibility usable with tagging, allocation, and clean data

Visibility is more than a dashboard. It’s consistent, trusted allocation that supports action.

For fintech teams, a tagging and allocation baseline usually includes:

- Product / business line

- Environment (prod, staging, dev)

- Cost center

- Workload type (API, batch, streaming, ML training, BI)

- Data classification (helps align cost with governance and audit needs)

Tools such as AWS Cost Explorer and Azure Cost Management help, but they depend on clean tagging and consistent account structure.

Quick win that matters:

Create a “no tag, no launch” gate for production infrastructure as a guardrail that prevents unknown spend from becoming permanent.

3) Shift from month-end surprises to real-time decisions

FinOps teams operate on short cycles because cloud changes daily. When cost signals arrive a month later, the money is already gone.

In real practice, fintech teams do things like:

- Auto-shutdown non-critical environments after hours

- Rightsize compute based on actual utilization

- Use commitment planning (Savings Plans, Reserved Instances) where usage is steady

- Move storage to lower-cost tiers with policy-based lifecycle rules

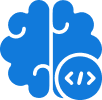

FinOps Foundation guidance frames this as a loop across visibility, optimization, and operations.

Example

A fraud model retrains nightly. The pipeline grew over time and now runs on larger nodes than needed. FinOps flags the change in cost per training run, the data team confirms stable runtime targets, and the platform team applies right-sizing and schedule controls. The end result is predictable spend without weakening detection.

4) Treat forecasting like a product KPI, not a finance exercise

Forecasting is where fintech teams often struggle because demand is real-time and spiky. Still, you can forecast well if you forecast the right thing.

Instead of asking, “What will AWS bill be next month?”, focus on:

- forecasted unit volumes (transactions, API calls, onboarding checks)

- expected model usage (training runs, inference calls)

- the unit cost curve (cost per 1,000 events)

Then tie cloud spend to those business drivers.

Cloud spend management remains a widespread challenge, which makes forecasting discipline a differentiator.

Where Inferenz fits: building data pipelines that merge billing exports, usage telemetry, and product metrics so forecasts reflect how the business actually runs, beyond what the invoice says.

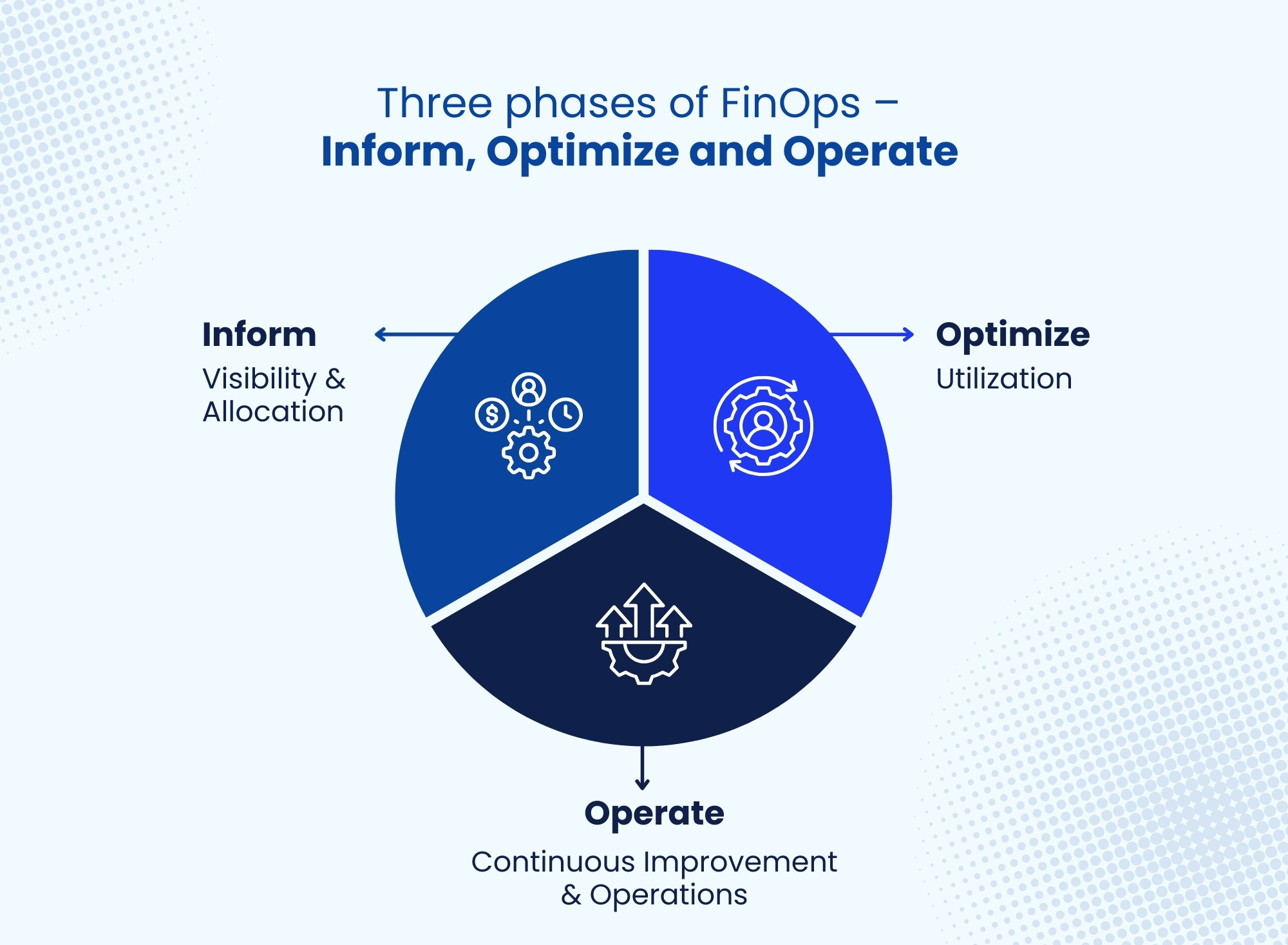

How fintech teams scale FinOps by maturity

Common roadblocks and how to get past them

- Resistance from teams

Engineers may assume cost controls will slow delivery. Fix that by using automation, clear thresholds, and fast feedback, not manual approvals. - Complex pricing and confusing bills

Cloud pricing is hard. The fix is to translate billing into “engineering terms” such as runtime, storage growth, egress, and query patterns. - Inconsistent governance

If tagging rules vary by team, visibility collapses. Standardize the minimum required tags and enforce them with policy.

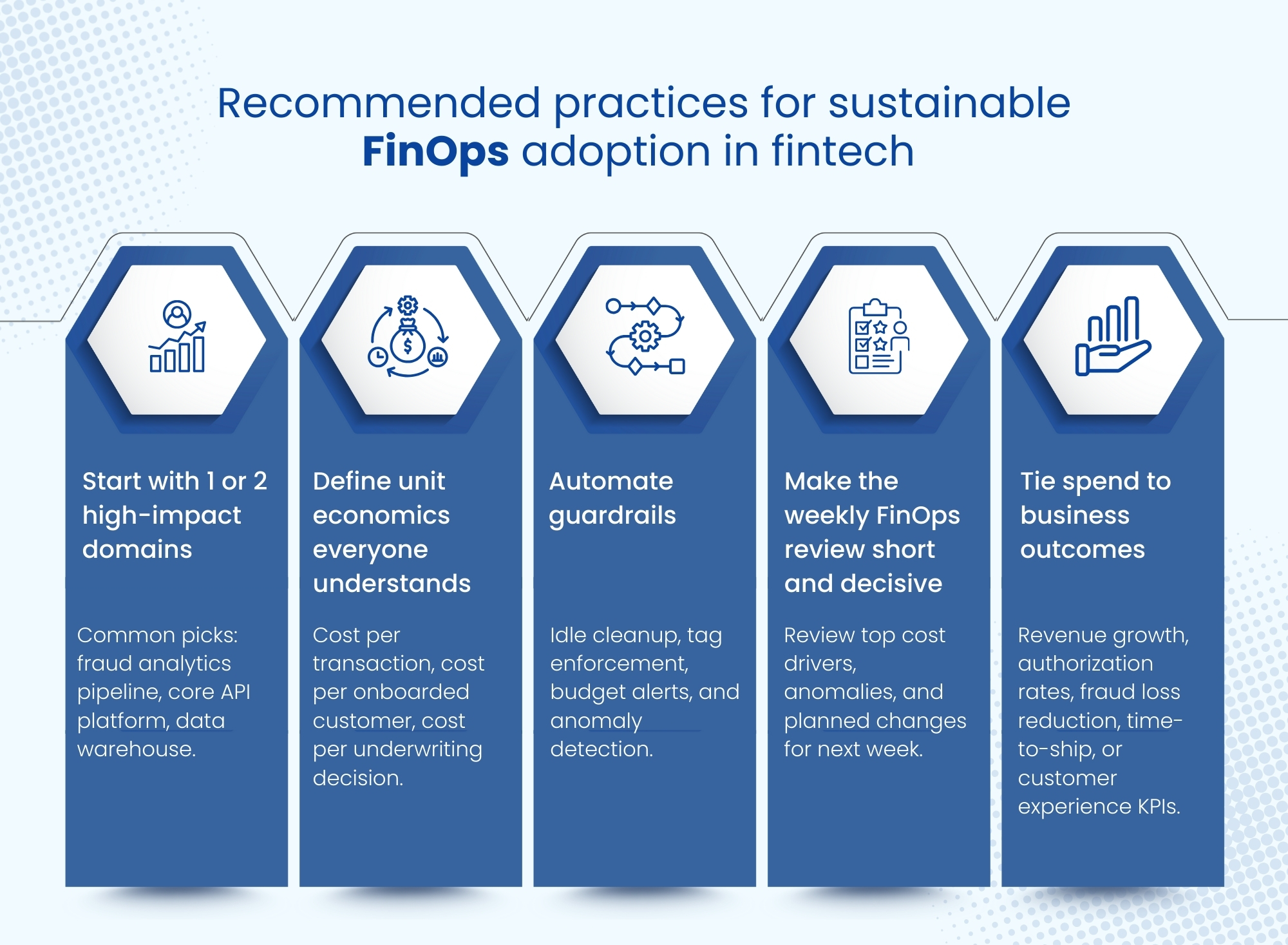

Recommended practices for sustainable FinOps adoption in fintech

- Start with 1 or 2 high-impact domains

Common picks: fraud analytics pipeline, core API platform, data warehouse. - Define unit economics everyone understands

Cost per transaction, cost per onboarded customer, cost per underwriting decision. - Automate guardrails

Idle cleanup, tag enforcement, budget alerts, and anomaly detection. - Make the weekly FinOps review short and decisive

Review top cost drivers, anomalies, and planned changes for next week. - Tie spend to business outcomes

Revenue growth, authorization rates, fraud loss reduction, time-to-ship, or customer experience KPIs.

Final thoughts

FinOps becomes valuable in fintech when it connects cloud spend to product reality: usage, risk controls, and customer outcomes. With the right allocation, unit economics, and automation, teams keep speed while making spend predictable and defensible.

Frequently asked questions

What is FinOps in a fintech cloud environment?

FinOps is how fintech teams manage cloud spend day to day, together. Finance, engineering, and product share ownership so costs stay visible, predictable, and tied to outcomes.

How do you measure cloud unit economics for payments and fraud workloads?

Pick a unit (cost per 1,000 transactions, cost per fraud check, cost per model run). Allocate cloud costs to that unit with tags and workload boundaries, then track the trend weekly.

What tagging strategy works best for cost allocation in regulated teams?

Keep required tags strict and few: Product, Owner, Environment, CostCenter, Workload, DataClass. Enforce tagging at creation time so production spend never shows up as “unknown.”

How do you forecast cloud spend when usage spikes daily?

Forecast the driver first (transactions, checks, model runs), not the bill. Use a rolling weekly forecast with a range (base/high), plus alerts for sudden spikes.