Challenges

- Manual extraction: Manual entry of various data points such as the entry of insured person, vehicle info, and coverage details leads to errors

- Time-consuming: Manual extraction causes delays in processing insurance claims.

- Error-prone data: Manual extraction increases the likelihood of errors in data entry, potentially resulting in inaccuracies in policy information and impacting the overall efficiency and reliability of insurance operations.

Solutions

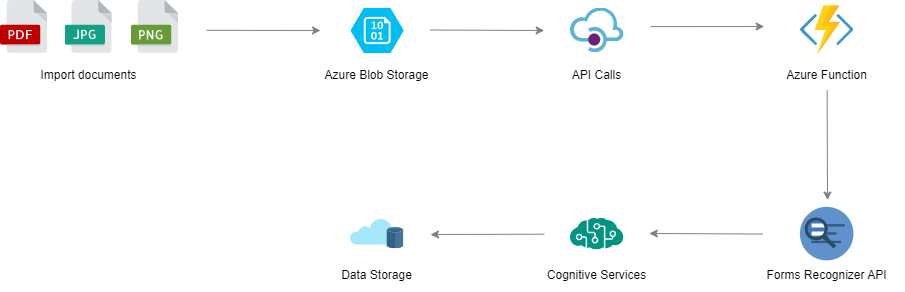

- Azure Form Recognizer Integration: Utilize Azure Function triggered by image URL for streamlined document processing.

- Tailored extraction with Azure Form Recognizer: Customization of Azure Form Recognizer ensures precise extraction of coverage-related details. The built-in model is trained and configured to accurately identify critical information like coverage limits, vehicle specifics, policyholder data, and other pertinent details essential for insurance analysis.

- Data Refinement: Employ Pandas, Regex, and Numpy for further data structuring and cleanliness post-Azure extraction.

- JSON Response via Azure API: Transmit structured JSON data through Azure API endpoint for seamless access and utilization.

Benefits

- Reduced manual entry errors: Azure Form Recognizer integration minimizes errors, ensuring accurate insurance data processing.

- Time saved per document: Implementing Azure Form Recognizer significantly reduces processing time by automating coverage extraction.

- Faster coverage processing: Azure Form Recognizer accelerates coverage information extraction, enhancing overall efficiency in insurance operations.

US based Leading Insurance company

The problem lies in the manual extraction of crucial data points, resulting in time-consuming processes prone to errors. These obstacles hinder efficient processing of insurance claims and jeopardize the accuracy of policy information.